BREXIT – Related Changes

3. 2. 2021, 16:50

Changes in filling in the customs declaration

Dear clients,

our partner for delivery of parcels to the UK (Royal Mail) informed us about fundamental changes in the completion of customs declarations and information that they need from us for a successful delivery of parcels to the UK.

Therefore, the following fields are now mandatory with immediate effect when completing the customs declaration:

➤ Product weight (new required field)

➤ HS code – customs code of goods

➤ Item description

➤ Country of origin

➤ Quantity

➤ Value (total value, not per piece)

It will not be possible to submit parcels to our system without filling in the required fields. Parcels that are already submitted and cannot be labeled are handled operatively and individually.

Thank you for your understanding,

Your Packeta

11.01.2021, 11:50

BREXIT and Complementary Information

Dear Clients,

We are sending complementary information and answers to your frequent questions regarding Brexit and shipping parcels to Great Britain (hereinafter UK). We are regularly updating all of the information for you in this article below. First of all, please note that even after concluding an Agreement, registration for tax payment in the UK and a personal EORI number are mandatory data.

Customs Clearance

It is necessary to state the origin of goods within the customs declaration for parcels with the value over 135 GBP. In the future, evidence of the origin of goods (the so-called preferential sentence) should be displayed directly on the label of the carrier. Our logistic partner is working on the modification and implementation of the label at this point in time, but in the future, it will be crucial for information about the origin of goods to be stated correctly at all times during the submission via API and also in the client section.

In the interim, which means until the completion of the label correction, please use this document for stating the origin of goods, which shall be filled out and inserted into the parcel. The second option is to insert the wording of the preferential sentence from the document directly on the invoice, which shall also be inserted into the parcel. We recommend providing the preferential sentence to accompany the parcel even after the change on the label because it is more valid evidence of the origin of goods for the customs office when entering the UK.

Thank you for your understanding,

Packeta

21.12.2020, 16:20

Attention: delivery to the UK is limited!

18.12.2020, 10:00

Brexit – Additional information

Marketplace, Ireland and the United Kingdom

Dear Clients,

Recently, we have informed you of the changes associated with sending to Great Britain with regards to GB leaving the European Union on the 1. 1. 2021. Now, we have more important information for you.

Sending to the Irish Republic (also IR)

Our current Hermes solution introduces parcel submission to Ireland via UK. Unfortunately, with this partner, we were not capable of coming up with an option, how to submit parcels directly to Ireland. This is why we have prepared a new solution for sending parcels to this country, this is via carrier Anpost.

The solution IE Hermes HD (ID 4524) will be turned off on the 23. 12. 2020. Right after this, the new carrier IE Anpost HD (ID 9990) will be available.

Sending to the United Kingdom of Great Britain and Northern Ireland (also UK)

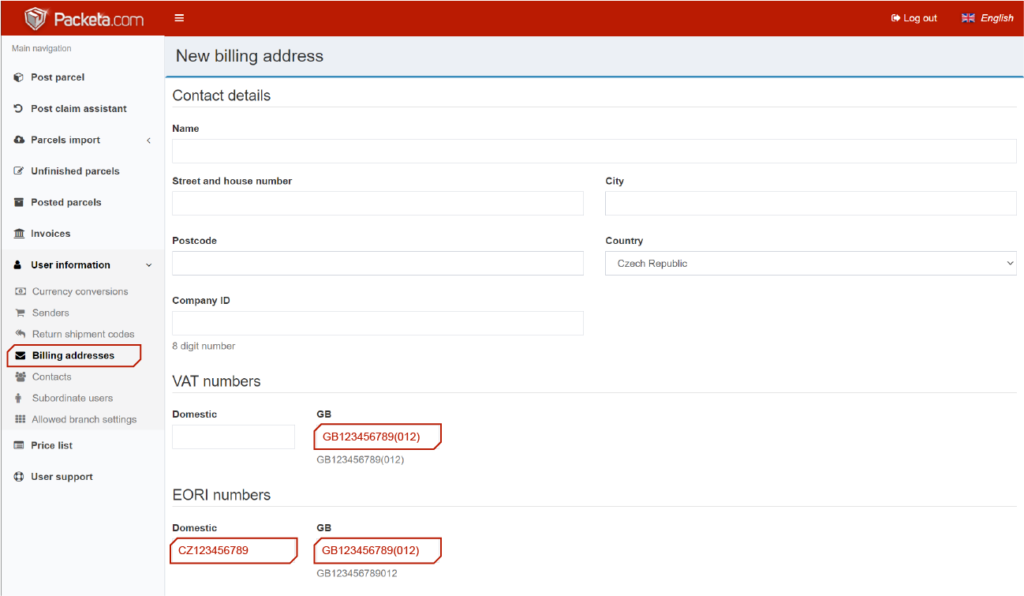

As we announced before, for sending goods to the UK, from the New Year, it will be necessary to be registered in the UK for paying VAT and have a generated UK EORI number. It will be necessary to fill in these numbers in the client section under your invoicing address (see picture below). In case you do not know the password for your client section, feel free to contact us via email customs@packeta.com, and we will help you fill in these numbers in your account.

If parcels are submitted via API, please take a look into our API documentation for the details on submitting customs declarations for service GB Royal Mail 24/48.

How to register for paying VAT in the UK and obtaining a UK EORI number?

You can find all the details below.

Sending via marketplace (Amazon, Ebay etc.)

The duty to register for VAT and EORI in the UK arises for the e-shop itself, or for the marketplace. This means that if you sell parcels via Amazon, Ebay or similar online marketplaces, you don´t have to perform registration. Nevertheless, it is necessary to state your UK VAT and UK EORI for your marketplace.

Our partner will pay duty and VAT for parcels over 135 GBP, and therefore, it is necessary to arrange with the specific marketplace, for them not to pay duty and tax for you in this case.

It is good to know: After the New Year, due to clearing, we will be changing the return address in the UK. Once the change is fulfilled, we will inform you immediately.

Dear Clients,

due to the end of the transition period, Great Britain is leaving the European Union on the 1.1.2021. Therefore, new rules will be applied for sending parcels to the UK and it will still not be possible to send a parcel without a customs declaration.

In order to guarantee the smooth transition to new processes associated with sending to the UK, it is necessary to adapt the following administrative requirements as soon as possible. It is quite last minute, but unfortunately our partners passed us the complete information just recently – and we are immediately passing it to you.

Important administration

From the European Union

First of all, it is necessary to fill in the Contract on Indirect Representation and Letter of Authorization for Tax Clearance, which can be downloaded here. It is also necessary to state your assigned number EU EORI in the contract. You should then send the filled in and signed document via e-mail:

recipient: customs@packeta.com

and state in subject: GB Letter of Authorization – name of your e-shop

To Great Britain:

The UK customs rules are quite different from the ones in other third countries. For sending parcels to the UK, at first, it is necessary to register for the payment of VAT in Great Britain and at the same time, have an assigned UK EORI number. Below you can find the links, which will help you with this administration:

What kind of customs limits apply to the UK?

- Payment of VAT from 0 GBP to 135 GBP

- Duty and DPH from 135 GBP

Transition of current services:

The service Royal Mail will be available in the current form until 20. 12. 2020 without a customs declaration. From 21. 12. 2020, it will be obligatory to fill in the customs declaration, in order to guarantee the smooth transition and parcel delivery. Therefore, when filling in the customs declaration, besides the standard boxes, it will also be necessary to fill in:

- UK EORI

- VAT number

- 10digit HS code

The carrier Royal Mail informed us that because of BREXIT and the associated customs clearance, the price for shipping parcels will increase from the 1. 1. 2021. At this moment, we are waiting for the final statement from their side. We will inform you of the price changes, once we know all of the details.

The service Hermes will be available until the 21. 12. 2020 for parcel submission without a customs declaration. Because it won´t be possible to ensure customs clearance through this partner, from the 22. 12. 2020, it will not be possible to submit parcels to this carrier. At the moment, we are working on a new solution, which will enable you to send parcels via Hermes with the possibility of ensuring customs clearance. In the meantime, it will be possible to use the service Royal Mail.

You are not sure about the categorization of your goods? We will be happy to give you advice on the address customs@packeta.com.